Continued: Best practices for accounts receivable management

Part II

In Part Two of our series on the accounts receivable process, guest blogger Sepideh Behram looks at best practices for handling outstanding receivables. Behram is the CEO of Ignite Revenue, Inc., a revenue recovery agency dedicated to supporting businesses in managing delinquent ARs to create an effective cash flow process.

Did you miss Part One? Catch up here.

It’s day 90 and your countless efforts at mailing invoices, sending email reminders and following up over the phone on that outstanding receivable have all failed. What can you do to ensure you get paid for a service you already provided?

Small business owners don’t often anticipate having outstanding receivables as they build out business plans, despite the fact that it’s almost a given that any business owner who invoices clients encounters a situation where an invoice is not paid. You can implement the following strategic processes to manage these stale accounts and spark some activity in hopes of recovery.

Write-off process

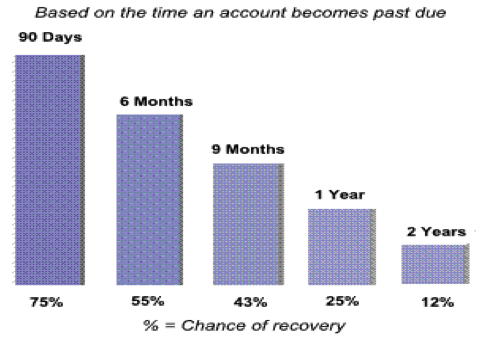

Business owners hold out hope that eventually their customers will make a payment, regardless of how old an account is. As the following graphic of recovery rates over time shows, waiting to get paid is not beneficial — the need to act on stale accounts is critical to your bottom line.

Business owners need to determine when they are ready to write off the balance as a bad debt and proceed to move the account off of their books. This generally happens between 90 and 180 days, after an internal collection has proven to be unsuccessful.

Third-Party Collection Agency

A business can place its delinquent or written-off accounts with a third-party collection agency. An agency becomes your partner throughout this process and will provide your business with a planned approach to collection. Given the vast array of resources an agency has, they can locate individuals and identify assets (often including employment information).

Hiring an agency can benefit your business in three ways:

- It allows your company to be optimally efficient. Employees can devote time and energy to other critical tasks to add to your bottom line.

- It improves the chances of your customers paying. An agency is prepared to “talk the talk” in a professional and compliant manner, quickly reaching a resolution.

- It provides expert advice. An agency understands debt and can walk through your stale accounts, making recommendations for process improvements to reduce delinquencies.

Agencies understand the regulatory arena and usually operate under a contingent fee agreement, which means that you won’t be charged if they don’t collect on the account.

It’s important to establish a relationship with an agency before the need for one arises so that you become familiar with their process and save yourself some time in the long run.

Litigation

You may inevitably encounter a few accounts that require litigation. This recommendation often comes from your collection agency as they investigate the debtor, make their communication attempts and consider statute of limitations provisions in the jurisdiction. Here are some jurisdiction-specific limitations:

DC

Contracts: 3 years

Judgments: 12 years

MD

Contracts: 3 years (with minor exceptions if contract is under seal)

Judgments: 12 years

VA

Contracts: 5 years

Judgments: 20 years

Litigation does not necessarily equate recovery. Once a case is filed, and if it is uncontested by the debtor, the court may decide to issue a judgment in your favor. Placing these judgments with a collection agency is also an option for post-judgment collection (in the form of a garnishment of either wages or bank accounts).

Don’t sit by and watch the embers of your stale accounts die out. Take a proactive step today to get your account information together, and contact a collection agency that can spark the revenue collection you have hoped for.

Blog contributed by Sepideh Behram, results@IgniteRevenue.com, www.igniterevenue.com